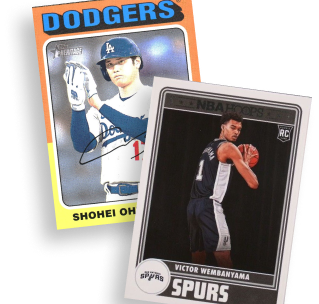

What’s the impact of Panini America’s NFL Players exclusive? Check back with us in 2020 …

Panini America’s Mark Warsop and NFLPI President Keith Gordon discuss the new deal between the companies that begins exclusively in 2016.

—

By Kevin Isaacson | Commentary

CLEVELAND | NFL general managers have a pat response when questioned about the current-year draft class: “Ask me in five years.”

Same is true in the sports card industry, especially as it pertains to licensing decisions. Any change in licensing prompts countless Chicken Littles to bemoan the hobby’s demise and activates even more glad-handers hoping to ingratiate themselves with the current manufacturing “winner.”

This month, the “winner” is Panini America, courtesy of its recently announced exclusive NFLPI deal. But the reality is the same, whether the topic is Upper Deck in hockey, Topps in baseball or any other licensing move: It is fun to debate, but we won’t know the full impact for at least five years!

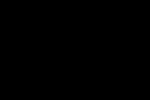

A Pop Warner team was among the guests for the Panini America Chalk Talk session where the company’s big news was first announced.

—

That’s a span of 150-plus football card releases. Unless you have the time-traveling abilities of Biff Tannen (Back to the Future 2 reference for those who weren’t attending movies in 1989), any first-week analysis of the Panini/NFL Players exclusive should be valued lower than any Ryan Leaf Rookie Card.

For those who don’t live on Twitter, here is the latest industry news alert: Panini America introduced its newly minted exclusive relationship with the NFL Players Association during the National Sports Collectors Convention, via lavish ceremony at a mid-town Cleveland hotel. Among the attendees: Execs from Pop Warner and the football Hall of Fame, legends Anthony Munoz and emcee Trent Dilfer; many of Panini’s wholesale distributors; and several executives from NFL Players. The announcement was positive and well-crafted, and certainly played well via corporate video. But assessing true impact? Neither the conspiracy theorists or the cheerleaders truly have a clue what the industry will look like in 2020.

That accepted, a few things are evident. They include:

— Incredible growth: In five short years, Panini’s North American profile has transitioned from UK-based sticker licensee to a mainstream leader in the trading card business. CEO Mark Warsop and his leadership team should be credited for bold vision and strong relationship-building. While Panini still trails Topps and Upper Deck in stateside brand equity by a good margin, the footprint established by the Dallas-based manufacturer in just a half-decade is impressive — especially given its primary competitors’ 25 and 60-plus years of hobby engagement.

— Shock and awe: The NFLPI-Panini announcement stunned U.S.-based hobbyists, especially given the solid performance of many Topps brands. It is fair to say that the traditional hobby distribution chain, over the recent past, has generated more profit via Topps than its competitors. The potential degredation of that revenue would make any business owner wary. But in assessing the new exclusive, one must understand that NFLPI’s ultimate allegiance is to its players. Clearly, NFLPI believes Panini is best positioned to invest in and market the union’s constituency. In fact, NFLPI president Keith Gordon said Panini spent “twice as much” as its competition on and with NFL players. What doesn’t seem to make sense within the hobby was apparently quite clear for the NFLPI.

— Focus on the future: The sweeping nature of the Panini-NFLPI partnership — at least six years in duration, with a significant investment in marketing and activation — will change the card landscape across North America and internationally. It is not a short-term play, which at least in concept is positive news for anyone wishing to spend their work week in the sports collectibles business in 2025, 2030 and beyond. All parties involved agree that the older collectors’ market is dwindling. The old business model is not sustainable, Gordon said, and the exclusive deal allows both Panini and NFLPI to evolve with the market. “Exclusivity helps us enormously,” said Mark Warsop, CEO of Panini America, “because a lot of the activation that promotes the category as a platform requires a lot of investment. We want to build the category itself and provide a new marketplace for the new demographic.” The changing market could include less expensive packs, an increased digital marketplace, and one of a kind high-end collector packages that might not have been available if Panini America was only focusing on beating its competitors.

— Business sense: When the NBA changed the hobby marketplace five years ago by selecting Panini as its exclusive trading-card licensee, an uncertain observer could have been justified in suggesting that the decision was an outlier: Basketball execs were crazy or simply experimenting, Panini paid too much, exclusive licenses were a risky bet, etc. Given the perspective of today, however, those five-year-old assessments don’t hold water. Today, every major U.S. sport has an exclusive trading-card licensee (Upper Deck for hockey, Topps for baseball, Panini for basketball and NFL players), so clearly, exclusives must not be universally bad, and basketball licensing execs weren’t singularly crazy in choosing Panini. Let’s be honest with ourselves, and agree to a couple realities: The licensors serving the trading-card industry are smart people, and Panini’s owners simply won’t allow it to operate for 10-plus years at a loss. Given that information, the licensing deal makes must make sense at a corporate level.

One more reality: Panini’s hard work is just beginning.

Panini execs must realize their brands are not strong enough to support a full, exclusive football license. They need to create several compelling brands in the next 16 months or acquire brands valued by collectors.

At this writing, Panini does not have an NFL Properties license for 2016-plus. Collectors simply won’t chase no-logo cards, as several erstwhile manufacturers have learned the hard way. The NFLPI license is a significant step, but Panini knows a “full” license is the best way to positively impact the hobby.

Topps’ strong brands will continue to impact the market until its license expires in early 2016, and very likely thereafter. GM Doug Kruep, speaking at a collector gathering in Cleveland, said, “We don’t have any plans of getting out of football.” I have no idea what that means for collectors, and Topps might not today, either. But the viability of Topps’ brands over the past 28 years and the company’s product-development acumen should not be discounted.

It was clear in Cleveland that the NFLPI is seeking to change the trading card category. That is good. Even those decrying the Panini deal will admit that new ideas, compelling technologies and an expanded collector base — including hobbyists living outside the United States — are critical to the hobby’s sustenance.

Let’s hope Panini delivers all of that and more, ideally sooner than 2020.

Kevin Isaacson is VP/Sales & Marketing for Beckett Media, and host of the popular Industry Summit trade conference. He has reported on and analyzed the sports trading card market for three decades.

That is very interesting that there is not yet an exclusive with NFL Properties. The NFLPI exclusive is really devalued if they cannot get a license for the logos as well. I would worry about NFL Properties leveraging that advantage and getting even more money out of Panini than ever.

Ultimately I find it disappointing to have Panini granted the exclusive. Topps’s history is strongest in football and baseball, and losing that history is disappointing.

To me, competition pushes companies to be better. In the end, I think exclusive deals produce more visible money but cause tangible harm to the hobby in the long run. To quote the article:

“Even those decrying the Panini deal will admit that new ideas, compelling technologies and an expanded collector base — including hobbyists living outside the United States — are critical to the hobby’s sustenance.”

Too true. What I dispute is this:

“The changing market could include less expensive packs, an increased digital marketplace, and one of a kind high-end collector packages that might not have been available if Panini America was only focusing on beating its competitors.”

So now the only motivation is profit. I’d bank on two licenses, which makes two motivations: Profit and beating the competition.

Great post. Of course, I always expect the best from Kevin Isaacson.

Based on Panini’s history for product improvement and leading the hobby in customer service, I have no doubt that Panini will deliver what customer’s want and expand the customer base.

I’ve been selling cards for over 30 years and owned a card shop since 1992. The future of collecting sports cards never looked better.

Hope this exclusive license doesn’t go down the same route that EA Sports did with Madden Football. Buy the license and then do nothing but put out cheap crap every year that people will buy because they want their favorite players in with their team logos. Instead of competing by producing quality products it’s cheaper just to buy off the competition and then spend no money on product development. I just think the NFL is getting ridiculous with trying to get as much money out of their product even if it hurts it’s fans. Thanks NFL.

No more Topps football cards? Sorry Charlie, won’t have a reason to come to your shop now.

A direct quote from the article: “NFLPI president Keith Gordon said Panini spent “twice as much” as its competition on and with NFL players. ” This is very clearly evident by the quality of product that Panini puts out. All of the money that should be going into their products is going to the athletes. This is why 4/5 of their boxes include a couple of 5 dollar autographs with a 100 dollar price tag. There are certain things that don’t need 5 years to assess. The worst card company getting an exclusive is never a good thing. Look at what you can buy Panini basketball products from the last few years at.

I am dreading Panini having an NFL exclusive license. They have the absolute worst customer service when it comes to redemptions and their products are loaded with them. Then they think the answer is going to be reward point cards that I still am waiting to know how each point is valued. That is a terrible alternative to redemption issues for many reasons. I STILL have outstanding redemption cards I have been waiting now 3+ years for and get no response from them anywhere I tried, and the rare case I have gotten someone on the phone (and it hasn’t been very many) they don’t follow through with what they said they would do. Last but not least I am surprised any other company or organization wants to do business with them because they have a grade of an F with the BBB and are not accredited with them. If you do the research it’s mostly due to their customer service especially regarding redemptions.

thanks for the story it clears up a lot just been hearing rumors I don’t do the face book or twitter crap. This sucks for me though all I collect in football is topps chrome. I have all ways hated the way all panini products look so I rarely buy from them. Oh well I guess its just time to sell off what I have prob for the best.

NFLPI: “SHOW ME THE MONEY!!!!!!!!!!!!!!!!!!!!”

Panini: *backs several Brinks armored trucks full of cash to NFLPI President’s office*

The result: “Panini and the NFL Players Association announce that they have entered into an exclusive multiyear agreement…”

Terrible, terrible decision to go exclusively with Panini. They cannot design a good-looking sports card, period. Their prices are outrageous. Their designs are horrible (did I mention that already?). But all that matters to both the NFL and Panini is money. I fully intend to show my displeasure by not spending a single penny on NFL-licensed football cards if this deal goes thru. Anyone who wants to voice their displeasure should also write/call/e-mail the NFLPI and let them know just how many millions upon millions of dollars they are going to lose out on with this deal.

To Nick in response to your comments. You say that panini is terrible with redemptions yet you fail to see the bigger picture. Other companies like upper deck and Topps will not honor expired redemptions and then you have to argue with them and they say well we can honor it as long as it’s not past a year from the expiration date. This has caused me multiple headaches and although I like buying some upper deck or Topps products, I dread getting a redemption from an older product bc I know that I’m not going to get the card. Panini is the complete opposite. They will honor any expired redemptions and if I had to choose between waiting an extended period of time for a redemption VS not be able to get it period I think the choice is obvious and you always have the opportunity to request a replacement card of equal value should you not want to wait.

To Dave regarding your comments. I dunno what planet you’re from but it’s not panini that sets the price of a product beyond their initial MPP period. It’s the distributors and the card shops that dictate that in most cases unless it comes directly from the manufacturer themselves and I can tell you panini products are way cheapie versus upper deck and Topps products but most importantly you get the best bang for your buck with panini products than you do with Topps or upper deck. They make products that are 75 bucks and don’t even guarantee a hit. I bought cases upon cases of 11/12 pinnacle for 300 a case and got just as many good hits as I would from some other product that’s three times the price.